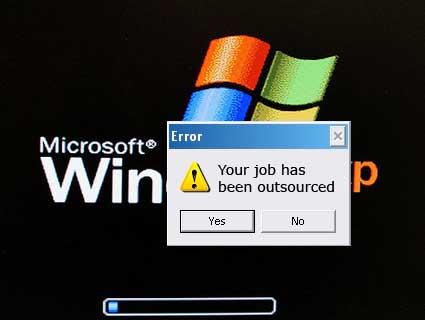

Microsoft Offshore Outsourcing

Who's buying Microsoft's outsourcing excuses? Microsoft has laid off 5,000 workers in the last year, but it still feels the need to outsource more IT jobs to India.

- Offshore outsourcing of software development presents. Adopting and Benefiting from Agile Processes in Offshore Software. Another Microsoft.

- A successful Offshore Software Development Company with decades of offshoring experience & trusted by leading multinational companies for software development.

Microsoft Corp. Is currently sitting on almost $29.6 billion it would owe in U.S. Taxes if it repatriated the $92.9 billion of earnings it is keeping offshore, according to disclosures in the company’s most recent annual filings with the Securities and Exchange Commission. The amount of money that Microsoft is keeping offshore represents a significant spike from prior years, and the levies the company would owe amount to almost the entire of the company’s home state of Washington. The company says it has 'not provided deferred U.S.

Income taxes' because it says the earnings were generated from its 'non-U.S. Subsidiaries” and then 'reinvested outside the U.S.” Tax experts, however, say that details of the filing suggest the company is using tax shelters to dodge the taxes it owes as a company domiciled in the United States. In response to a request for comment, a Microsoft spokesperson referred International Business Times to 2012 U.S. Senate from William J. Sample, the company’s corporate vp for worldwide tax.

He said: “Microsoft’s tax results follow from its business, which is fundamentally a global business that requires us to operate in foreign markets in order to compete and grow. In conducting our business at home and abroad, we abide by U.S. And foreign tax laws as written. That is not to say that the rules cannot be improved - to the contrary, we believe they can and should be.” The disclosure in Microsoft’s SEC filing lands amid an intensifying debate over the fairness of U.S.-based multinational corporations using offshore subsidiaries and so-called 'inversions' to avoid paying American taxes. Such maneuvers - although often legal - to signficantly reduce U.S. Corporate tax receipts during an era marked. White House officials have the tactics an affront to 'economic patriotism' and President Obama himself has derided 'a small but growing group of big corporations that are fleeing the country to get out of paying taxes.'

In a, he said such firms are 'declaring their base someplace else even though most of their operations are here.' 'I don't care if it's legal; it's wrong,' Obama said. Meanwhile, Democratic lawmakers have been pushing they say would discourage U.S. Companies from avoiding taxes through offshore subsidiaries. The proposals are being promoted in advance of the 2014 elections, as suggests the issue could be a winner for the party. In Illinois, the issue has already taken in the state’s tightly contested gubernatorial campaign. Because Microsoft has not declared itself a subsidiary of a foreign company, the firm has not technically engaged in an inversion.

However, according to a 2012 U.S. Senate, the company has in recent years its offshore subsidiaries to substantially reduce its tax bills. That probe uncovered details of how those subsidiaries are used. In its report, the Senate's Permanent Subcommittee on Investigations described what it called Microsoft’s “complex web of interrelated foreign entities to facilitate international sales and reduce U.S.

And foreign tax.” The panel’s noted that “despite the company’s research largely occurring in the United States and generating U.S. Tax credits, profit rights to the intellectual property are largely located in foreign tax havens.” The report discovered that through those tax havens, “Microsoft was able to shift offshore nearly $21 billion (in a 3-year period), or almost half of its U.S. Retail sales net revenue, saving up to $4.5 billion in taxes on goods sold in the United States, or just over $4 million in U.S.

Taxes each day.” U.S. Carl Levin, D-Mich., at the time: “Microsoft U.S. Taxes on 47 cents of each dollar of sales revenue it receives from selling its own products right here in this country. The product is developed here.

Offshore Outsourcing Definition

It is sold here, to customers here. And yet Microsoft pays no taxes here on nearly half the income.” and, which also employ offshore subsidiaries, are the only U.S.-based companies that have more money offshore than Microsoft, according to compiled by Citizens for Tax Justice.